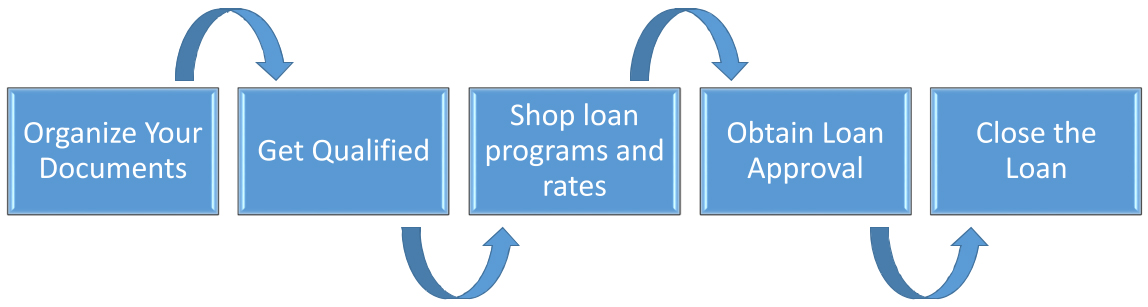

About the Loan Process

1. Organize your Documents

There are many paths toward loan approval. And there are still some limited-documentation loans. But if you want the very best rates and terms available, most lenders will request the following:

- If you are a salaried employee: provide two years W-2s and one month of pay stubs. If you are self-employed: provide a copy of your business license

- If you own rental property, please provide rental agreements and/or two years tax returns

- If you wish to speed up the approval process, please also provide two months bank statements for all bank, stock and mutual fund accounts

- Provide recent copies of any stock brokerage or IRA/401K accounts that you may have

- Clear photocopy of your valid driver’s license

- Provide a copy of divorce decree if applicable

- If you are not a U.S. citizen, provide us with a copy of your green card (front & back), or if you are not a permanent resident provide us with your H-1 or L-1 visa

2. Get Qualified

When buying a house, it is important to get pre-qualified – and even better to get pre-approved.

A pre-qualification is normally issued by a loan officer, who, after interviewing you, determines the loan amount for which you would be approved. However, loan officers do not make the final decision, so a pre-qualification is not a commitment to lend. After the loan officer determines that you pre-qualify, he/she then issues you a pre-qualification letter. And this pre-qualification letter is submitted with your offer on a property – indicating to the seller that you are qualified to purchase the house on which you are submitting an offer.

Pre-approval is a step above pre-qualification, and involves verifying your credit, down payment, employment history, etc. At Underwood Mortgage Group we take this extra step to strengthen your offering position. Because we are a Direct Lender in possession of the most advanced automated loan underwriting software available, we can verify your preliminary approval in just a few hours – not days like other lenders. And once you are pre-approved, you are in a better position to negotiate with the seller. And you’re able to close in days instead of weeks.

3. Shop Loan Programs and Rates

- Think about how long you plan to keep the loan. If you plan to sell the house in a few years, you may want to consider an adjustable-rate mortgage. On the other hand, if you plan to keep the house for a longer period of time, you may want to look at 15- or 30-year fixed-rate loans.

- Understand the relationship between rates and points. Points are considered to be “prepaid interest” and are tax deductible. Each point is equal to one percent of the loan amount. So for example, one point on a $150,000 loan is $1,500. And keep in mind that points should “buy down” your rate. The more points you pay, the lower your rate should be – otherwise, they’re going in someone’s pocket.

- Compare different programs. Shopping for a loan can be difficult. With so many programs to choose from, each of which has different rates, points and fees, it's hard to figure out which program is best for you. That's where an experienced Mortgage Consultant can clearly present all of your options and help you choose the loan that's best for you.

4. Obtain Loan Approval

Once your loan application has been received, the lender will issue a formal loan approval by verifying application and documentation. At this time, additional documents or verification may be required. To streamline the approval process:

- Be completely honest and as accurate as possible as we complete your application during our initial interview.

- Respond promptly to any requests for additional documents. This is especially critical if your rate is locked or if you plan to close by a certain date.

- Do not make any major purchases. Do not buy a car, furniture or another house until your loan is closed. Anything that causes your debts to increase may have an adverse affect on your credit score and approval.

- Do not move large sums of money into your bank accounts unless it can be traced. Especially cash – no not deposit cash into your account if at all possible. If you are receiving money from friends, family or relatives, please contact us for advice.

- Plan to be in town around your scheduled closing date. If you must leave, we recommend you sign a “limited power of attorney” authorizing another individual to sign on your behalf.

5. Close Your Loan

After your loan is approved, you will be required to sign the final loan documents, Note, Deed of Trust, etc. This normally takes place with a notary public in an escrow office, or we can arrange for a “traveling notary” to meet you wherever convenient. Be prepared to:

- Bring a cashier’s check if you do not plan to wire funds into escrow for your down payment and closing costs if required. (Personal checks are normally not accepted.)

- Review the final loan documents – verifying that the interest rate and loan terms are exactly as quoted. And if not, do not hesitate to call your Mortgage Consultant for clarification or correction.

- Lastly, verify that the name and property address are accurate, and sign your loan documents.

Your loan will normally close shortly after you have signed the loan documents. In a purchase transaction, loans typically fund the day after signing and record the following day. Keep in mind that your loan and/or home purchase are not officially “closed” until after “recording” with the county of the property.